A Clear Rationale for Emerging Strategy Outperformance

This is an incredibly exciting time for ESG hedge funds, launches have spiked in 2020 and are expected to grow

through the next several years. These types of funds implement ESG specific hedge fund strategies, such as a

“carbon neutral long/short equity fund” or an “energy transition event driven credit

fund”. I believe there is tremendous opportunity out there, and these managers will outperform, either

because of structural ESG tailwinds or due directly to ESG-related alpha. However, I do know there are many “ESG

skeptics” out there, and I plan to present an alternative view of ESG hedge funds.

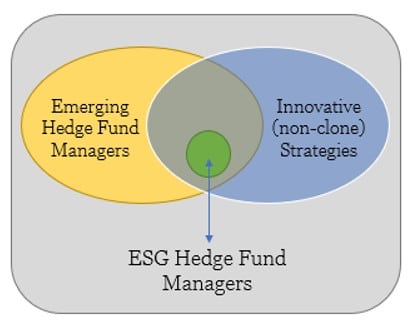

Let’s take a step back and look at these new funds in two ways:

1) Emerging managers

2) Innovative new strategies

When looking at emerging hedge fund managers, ESG or otherwise, the academic literature has provided evidence that

these managers outperform their more established peers – most notably from “The Performance of Emerging

Hedge Funds and Managers” (Aggarwal and Jorion 2007). The data indicates that incentive effects are

stronger for emerging managers because of the lower initial wealth any marginal increases in profits create a

greater impact. Also, because of their size, they are more nimble than established managers thus being able to

quickly take advantage of investment opportunities.

Being able to classify ESG hedge fund managers as emerging gives us our first positive indication that ESG hedge

funds will outperform more established managers. Generally, the outperformance of emerging managers is a strong case

to invest in ESG hedge funds, but I do understand that may not be sufficiently compelling. I want to take it one

step further and bolster the argument with evidence from new research, which demonstrates that emerging managers

with “Innovative Strategies” will outperform.

New Emerging Hedge Fund Manager Data

In a paper from July 2020, “The Economics of Hedge Fund Startups: Theory and Empirical Evidence,” Charles Cao, Grant

Farnsworth, and Hon Zhang offer compelling evidence that there are specific sub-sets of emerging managers that

outperform. They looked at three characteristics of the emerging fund: (1) the popularity of the fund’s strategy

based on investor demand (Hot v. Cold); (2) if the fund was part of a fund family at an existing firm; and (3) if

the investment strategy is a clone strategy—a strategy that already exists or is set up in a similar way to attract

new assets.

The authors posit that “these results provide strong support to the prediction that superior-performing new hedge

funds can be identified ex ante based on an understanding of the effects of investor demand and family

structures” (Cao, Farnsworth, and Zhang 2020). Though I take anyone saying that they can identify anything ex

ante with a grain of salt, all three of these characteristics can be helpful in understanding and breaking down the

outperformance of emerging managers.

While the data for hot versus cold inceptions and standalone versus family affiliated funds is fascinating, I’ll come

back to these topics in the future. Right now, I want to focus on the idea of non-clone strategies and how they can

be viewed in terms of ESG-focused hedge funds.

ESG as Non-Clone Strategies

Clone inceptions are fund launches that closely mimic an already existing strategy, essentially a means to gobble up

excess strategy demand. Conversely, a non-clone fund would implement a new innovative strategy and because of this,

the fund is expected to outperform, as noted by the authors: “We expect clone funds to deliver poorer

performance than non-clones.”

When I think of new and groundbreaking strategies, my mind immediately goes to ESG strategies, likely, because ESG is

where my research has been focused. Nevertheless, these are undoubtedly innovative strategies and include long/short

equity managers that focus on companies that contribute an impact aligning with one or several of the 17 Sustainable

Development Goals, or SDGs, created by the United Nations. There are funds that specifically focus on offsetting

carbon use and greenhouse gases in our atmosphere, as well as funds that solely focus on facilitating the energy

transition from fossil fuels to electricity.

These are not just noble pursuits but are also pioneering hedge fund strategies that the data suggests may lead to

outperformance. Selecting emerging managers comes with its own challenges, but I think this evidence is compelling

enough to allocate resources to the space. If you allocate to hedge funds and are still skeptical of the

return potential of ESG hedge funds, then try thinking of them as an emerging manager

with an innovative strategy.

As more resources are funneled into ESG and responsible investing research, we will soon have definitive academic

studies proving that specific ESG factors contribute to alpha. That day is quickly approaching, but until then, a

strong argument can be made for outperformance of emerging ESG hedge fund managers by using the available data and

viewing them through the lens of emerging managers with innovative strategies.

Contact the Author

Gregory Neal, Director of Investments. investments@hfr.com

Learn more about HFR Investments at:

https://hfr-investments.com or e-mail us at investments@hfr.com

A downloadable copy of the article may be found here:

Disclaimer: This article does not constitute an offer, or a solicitation of an offer,

to buy or sell any securities, and is intended for informational purposes only. Any offer of an HFR Fund will be

made solely by a Confidential Offering Memorandum, and then only to qualified purchasers. This document is

confidential and is intended solely for the information of the person to whom it was delivered. It is not to be

redistributed to any third parties without the prior written consent of HFR Investments, LLC (“HFR”).

Opinions, estimates, forecasts, and statements of financial market trends are based on current market conditions

constitute judgment, may prove inaccurate, and are subject to change without notice. Our views, strategies, and

examples may not be suitable for all investors. References to specific strategies are for informational purposes

only, and is not investment advice, and should not be interpreted as a recommendation.

A Confidential Offering Memorandum will set forth the terms of an investment in a fund, including risk factors,

conflicts of interest, fees and expenses, and tax‐related information. Such material must be reviewed prior to any

determination to invest in any of HFR’s funds.

©2020 HFR Investments, LLC, all rights reserved. HFR®, HFRI®, HFRX®, HFRq®, HFRU, and HEDGE FUND RESEARCH™ are

the trademarks of Hedge Fund Research, Inc.